NASA, Space Exploration, and American Public Opinion

Since the 1960’s, the American public has often been proud and supportive of NASA, and while the contours and intensity of that support have changed with the decades, the core perception Americans’ have of their space program hasn’t altered and cuts across every available demographic slice of the country. However, this unity is not a feature of the system destined to continue unchanged, and 2020 is already proving to be a tumultuous year for the ages. It’s appropriate to dive into the recent polling data and recap where the public stands on NASA as the country proceeds through a pivotal election cycle and a general period of mass uncertainty.

Polling data for this article is heavily sourced from the Nirgal.org Polling Database, and includes four high quality polls taken in 2018 and 2019 conducted by Pew, CSPAN/IPSOS, CBS, and AP-NORC. These polls were extensive and focused exclusively on space related issues, creating a large pool of data for us to review and analyze.

In short, the American public has very positive feelings towards NASA and its missions, and generally sees space exploration as beneficial to society. This support is uncommonly broad in what is often a divided nation, but a deeper dig into the data reveals far more nuance and uncertainty, as well as some divisions and disagreements.

The following sections are designed to break down this large pool of data to capture the full scope of what it’s telling us. Each section has both hard data points in list form, as well as a written analysis. If you want the super short version, the final section is a summary and key takeaways.

Areas of Overwhelming Agreement

Across all 4 polls, a number of NASA-related issues garnered widespread support among a very large segment of the public. The long list of data points includes:

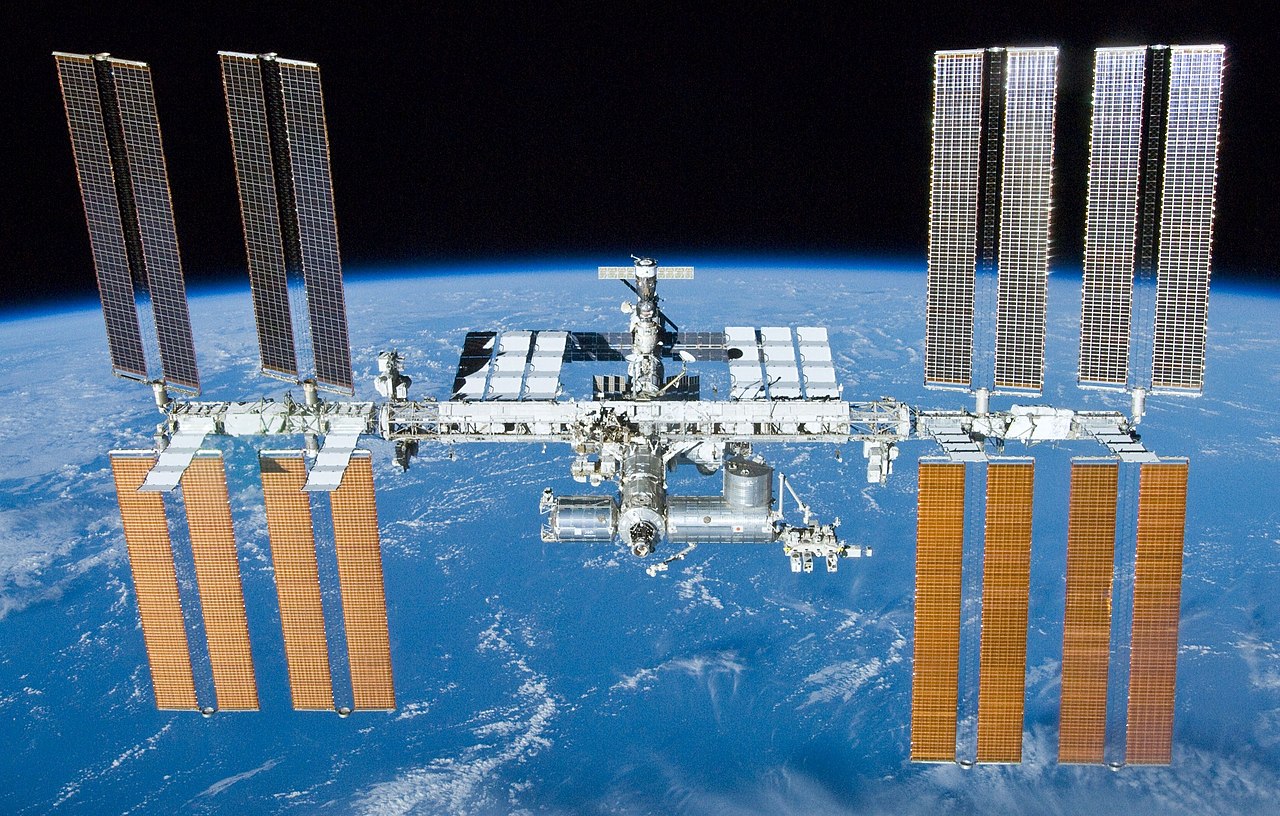

- 80% see the ISS as a good investment for the country. (Pew)

- 80% believe space travel supports scientific discovery. (CSPAN/IPSOS)

- 79% say NASA contributes to scientific advancement. (CBS)

- 78% have an overall favorable impression of NASA. (CSPAN/IPSOS)

- 77% believe space travel inspires young people. (CSPAN/IPSOS)

- 75% believe in life elsewhere in the Universe, and 65% believe in intelligent alien life. (AP-NORC)

- 73% believe space travel helps with natural disaster response. (CSPAN/IPSOS)

- 73% say NASA contributes to pride and patriotism. (CBS)

- 71% agree NASA is necessary. (CSPAN/IPSOS)

- 70% say both NASA/private sector have a role to play in space exploration. (CBS)

All 4 polls found widespread support for NASA, the International Space Station, and a general belief that NASA contributes to scientific discovery and the inspiration of young people. Support of this magnitude demonstrates that, broadly speaking, NASA is a unifying and positive force in American politics and society.

For comparison, according to Gallup, the US military has a 73% favorability rating among Americans, while small business clock in at 68%. Gallup has also found that nurses (85%), engineers (66%), doctors (65%), pharmacists (64%), and dentists (61%) are the professions most seen by Americans as being honest and ethical. This is the honorable company that NASA keeps.

Personal Behavior & Attitudes

There is a wide range of interest levels in space among the American public, spanning the range from passionate believers to those with zero interest at all. A wide swath of America has actively participated in a ‘passive’ space related event or activity, but is far more hesitant when talking about traveling to space themselves.

Familiarity & Interest

This section is a brief overview of American’s self-professed familiarity with and interest in space, broken down between CSPAN/IPSOS and Pew data.

CSPAN/IPSOS

- 56% of Americans say they are at least ‘familiar’ with space and/or astronomy.

- 21% consider themselves ‘very interested’ in space.

- 5% consider themselves to be ‘well informed’ on space issues.

Pew

- 7% of the public has heard a lot about both NASA & private space companies (a.k.a. space wonks like this author), 22% have heard nothing, and 71% are in between.These 7% are 10-45% more likely to be more supportive of NASA and its missions on any given question. The widest examples of this gap are:

- 92% believe private space companies can control costs, compared to 47% of low information respondents.

- 95% believe private space companies will build safe and reliable spacecraft, compared to 60% of low information respondents.

- 75% believe scientific research should be a top NASA priority, compared to 31% of low information respondents.

- Oddly enough, of these 7% high information respondents, only 55% believe NASA is ‘essential’, compared to 45% who do not. 66% of medium information and 68% of low information respondents believe NASA is ‘essential’.

- 74% of the high information respondents would orbit the Earth, compared to 30% of low information respondents.

The data points to shades of interest in space, with a core group of highly passionate enthusiasts (anywhere from 10-20% of the electorate), a large group of people familiar with space but not avid followers (roughly 60-70%), and a group with no self-professed exposure or interest (roughly 20%).

A more in depth study of these breakdowns by enthusiasm would be highly revealing, and there are hints of this dynamic at play in the following sections.

Activities Americans have done/ would consider:

This section is a brief overview of the activities Americans have/would consider doing relating to space.

- 75% of Americans have watched a lunar eclipse. (CSPAN/IPSOS)

- 68% have watched shooting stars. (CSPAN/IPSOS)

- 65% have watched a shuttle launch. (CSPAN/IPSOS)

- 52% have watched a meteor shower. (CSPAN/IPSOS)

- 50% believe space tourism will be a reality within 50 years. (Pew)

- 42% would orbit the Earth if given the chance, 58% would not. (Pew)

- 31% of those asked say they would go to Mars, but less than ½ would go if it was a 1-way trip. (AP-NORC)

Those who would travel to orbit list uniqueness, curiosity, and seeing the Earth from orbit as their primary motivations. Those who would not travel to orbit list cost, fear, and health as their primary motivations.

As the data shows, the ‘passive’ astronomy activities are very popular, and most Americans have done them. When it comes to space tourism and seeing themselves in space, the majority of Americans are far more hesitant. The insatiable curiosity that has always been a primary driver of space exploration is widespread in the country, with 42% translating to roughly 138 million Americans.

The trendline is clear though. The more ambitious the activity or destination, the smaller the circle of willing participants (also 15% of respondents in the AP-NORC poll being ok with a one-way trip to Mars is significant). It’s likely further analysis would reveal that the more willing a person is to travel further out into the Solar System, the more likely they are a member of the ‘high interest’ group mentioned earlier.

Public Priorities/Rankings

There are some very revealing and informative rankings in the data on public priorities for NASA and views on various organizations in the space sector.

AP-NORC asked the public “How important is it for NASA to do X?”

- Asteroid Defense - 68%

- Study the Universe - 59%

- Send probes to explore Solar System - 47%

- Maintain the International Space Station - 42%

- Find life on other planets - 34%

- Send astronauts to Mars - 27%

- Send astronauts to Moon - 23%

- Establish a permanent presence on other planets - 21%

- Establish a military presence in space - 19%

AP-NORC asked the public “Who should have (a leading role/some role/no role) role in space exploration moving forward?”

- US government - 60%/33%/6%

- Colleges & universities - 42%/43%/14%

- Private companies - 41%/43%/14%

- Other nations - 38%/48%/12%

Pew asked “Should X be a (Top/Low/Not) a priority for NASA?”

- Climate - 63%/25%/11%

- Asteroid defense - 62%/29%/9%

- Space Research - 47%/40%/12%

- Develop new technologies - 41%/44%/4%

- Study human health in space - 35%/41%/20%

- Search for raw materials - 34%/43%/22%

- Search for life on other planets - 31%/42%/27%

- Send astronauts to Mars - 18%/45%/37%

- Send astronauts to the Moon - 12%/42%/44%

Pew asked the public “Do you have confidence (great deal/fair/not too much/none) in private companies to do X?”

- Make a profit from their endeavors - 44%/36%/14%/4%

- Build safe and reliable spacecraft - 26%/51%/17%/5%

- Control costs - 24%/41%/26%/9%

- Conduct research - 23%/47%/22%/7%

- Control space debris - 13%/35%/38%/13%

This data points to a public that still puts faith in the US government when it comes to space exploration, but is open to and supportive of private companies (though not to clean up after themselves). It is also abundantly clear, in multiple polls, that the public wants NASA to prioritize climate change, scientific research, and asteroid defense. Crewed missions beyond low Earth orbit are prioritized at a lower level by the general public regardless of which poll you look at.

The militarization of space ranks the lowest priority in the AP-NORC dataset at just 19%, and the CSPAN-IPSOS poll found the approval rating of the Space Force at 31% (only 23% awareness). This data point bears watching as the Space Force is still getting organized, and public opinion, while not supportive now, remains largely unformed.

Despite hints from the earlier segments, further analysis is required to truly understand the impact interest intensity has on how people respond to these rankings. We know those who are more interested in space are more supportive of scientific research, are highly supportive of private companies, but also have more nuanced views towards NASA and its future. It’s unclear how intensity would fully break down on questions relating to crewed missions to the Moon and Mars, the search for life, climate change research, or asteroid defense.

Money Issues

When it comes to NASA’s budget, the public expresses a significant amount of uncertainty, with roughly half not even expressing an opinion as to whether it is too high or low. Question wording also generates statistically significant changes in responses, indicating that framing and context of the question is playing a sizable role in informing responses. This demonstrates a lack of hard formed opinions among the vast majority of the public.

CBS data shows that 32% of Americans say NASA’s budget is too low, while 21% say it is too high. This number is up from 16% ten years ago, and 15% twenty years ago, showing a growing share of Americans expressing the belief that NASA does not receive enough funding. Yet this growing cohort is still only a plurality, not even yet ⅓ of the public.

CSPAN/IPSOS data shows a similar 31% of Americans say NASA should get a budget increase, while 14% say NASA should be cut and the $ sent to private companies (55% don’t know). CSPAN/IPSOS actually asked two separate budget questions with very different framing to measure the impact on how American’s perceive NASA’s budget. The results were profound.

When presented in absolute terms ($22 billion), 27% say NASA’s budget is too high, 20% say too low. When presented as .5% of the federal budget (or roughly $70 per American), 41% say NASA’s budget is too low (+21%), while 31% say it’s too high (+4%). This 21% point swing in ‘too low’ responses based purely on the wording of the question demonstrates the power of messaging and framing when advocates discuss NASA, it’s budget, and it’s priorities. This is most likely a swing among the low interest voters discussed in earlier sections.

The small swing in responses saying NASA’s budget is too high (only 4% points), reveals a harder core of voters who more likely than not oppose most federal spending across the board (anywhere from 15 to 30% of respondents). There also appears to be a solid 30% or so who support increasing NASA’s budget regardless. That remaining 40%+ appears either indifferent or persuadable, based on framing and context.

Genuine Differences

While space exploration most often generates universally positive feelings across the electorate, there are instances where partisan, gender, or other demographic differences do become noticeably pronounced. This is not meant to highlight these issues as a wedge, or increase acrimony in the space community. It’s important to understand how different groups perceive and prioritize space exploration, so proper analysis and decision making can be made for the future.

These are broken down into discrete sections for better analysis.

Generational and Age Differences

Age gaps appear in both budgetary and personal travel questions. Younger voters appear more open to increasing NASA’s budget according to CBS data, and are more open to visiting off-Earth destinations (Low Earth Orbit, the Moon, or Mars) according to Pew and AP-NORC.

On NASA’s budget, 38% of those under 30 say it’s too low, compared to 29% of those over 30. (CBS)

AP-NORC asked “Would you be willing to X?” (under 50/over 50)

- Go into orbit? (63%/40%)

- Go to the Moon? (52%/27%)

- Go to Mars? (45%/16%)

Pew asked “Are you interested in space tourism?”

- 63% of Millennials, 39% of Gen Xers, and 27% of Boomers said ‘Yes’.

Gender

The Pew data revealed a number of differences in support between men and women when it came to various questions throughout the entire data sample. The trend is obvious, but it’s cause is not, and I would warn against reading anything more into this other than a need for far more extensive analysis.

- 77% of men see the US as a world leader in space, compared to 66% of women.

- 84% of men see the ISS as a good investment, compared to 76% of women.

- 63% of men see humans as essential to space exploration, compared to 54% of women.

- 54% of men see general space research as a NASA priority, compared to 40% of women.

- 51% of men say they would orbit the Earth, compared to 31% of women.

- 25% of men see research into human health in space as a NASA priority, compared to 11% of women.

- 74% of men have a fair amount or great deal of confidence that private space companies will build safe & reliable spacecraft, compared to 56% of women.

- 85% of men have a fair amount or great deal of confidence that private space companies will control costs, compared to 69% of women.

Partisan

The Pew data revealed a series of partisan differences on various questions, some conforming to popular political conceptions, others slightly more surprising. Overall, Democrats are more supportive of NASA’s work on climate, space research, and searching for life on other planets.

- 70% of Democrats believe NASA should continue and not give way to private companies, as opposed to 59% of Republicans.

- Moderate/liberal Republicans support NASA’s future at a 67% clip, while conservative Republicans are split 53%-47%,

- 78% of Democrats believe NASA should prioritize climate research, compared to just 44% of Republicans.

- 53% of Democrats should believe NASA should prioritize general space research, compared to 38% of Republicans.

- 34% of Democrats believe NASA should search for life on other planets, compared to 26% of Republicans.

US Leadership in space

The data reveals somewhat contradictory responses when it comes to US leadership in space. Pew data shows an American public that broadly considers the US the world leader, while the CBS and AP-NORC data shows a public that sees the US as one of many leading spacefaring nations.

- 72% see the US as a world leader in space. (Pew)

- 40% say the US is a leader in space, 43% say one of many nations. (CBS)

- 17% say the US is the sole leader in space, 64% say one of many, 17% say not a leader at all. (AP-NORC)

Crewed presence

The electorate demonstrates considerable fluidity of opinions regarding support for crewed missions, especially to deep space. Both the AP-NORC and Pew data paint a complicated picture of where the public stands, and it reveals the differences in ‘high’ and ‘low’ interest voters from previous sections.

AP-NORC

- Do you favor ‘the’ return to the Moon, yes or no? (reference to NASA’s Artemis Moon program). 42% favor, 20% oppose

- When given a choice, 37% of respondents prioritize a mission to Mars 1st, 18% prioritize a return to the Moon 1st, and 43% actively say neither.

- 27% say it’s important for NASA to send astronauts to Mars.

- 23% say it’s important for NASA to send astronauts to the Moon.

- 21% say it’s important for NASA to establish a permanent presence on other planets.

Pew

- Are humans ‘essential’ for space exploration? 58% say yes, 41% say no

- How high of a priority is sending crews to Mars (high/medium/low)? 18%/45%/37%

- How high of a priority is sending crews to the Moon (high/medium/low)? 12%/42%/44%

The public can’t seem to make up its mind on the role they envision for crewed missions in space. Support for crewed missions as a concept is well over 50%, but support for missions beyond Low Earth Orbit to the Moon or Mars rank low on priority lists, and even the high water mark is only 42% when asked specifically about NASA’s Artemis program.

The 12% and 18% ‘high’ importance marks are almost certainly the high interest voters discussed earlier, and fit perfectly within the 10%-20% range we established.

In the Pew rankings, the 37% and 44% ‘low’ importance measures for the Mars and Moon missions respectively were 10% higher than the next highest item (the search for life). Combined with the 43% who actively stated ‘neither’ to AP-NORC when asked to prioritize Moon vs. Mars, this conforms roughly to the significant minority of the public described as ‘low interest’ earlier. A deeper analysis into this subgroup would likely reveal some fascinating insights.

Fun Facts

Neil Armstrong is among the most well known Americans ever, with a name ID of 83% according to CSPAN/IPSOS. Buzz Aldrin is behind him at a respectable 68%, while SpaceX Founder Elon Musk comes in at 57%. (No polling information exists on the name ID of Jeff Bezos).

Key Takeaways

Now it’s time to summarize the analysis and see what it reveals.

- Americans have broadly positive views of NASA, the International Space Station, and the scientific work NASA does. They believe it is an example of national pride and patriotism, and believe it serves to inspire young people.

- Personal behavior and attitudes reveal widespread participation in ‘passive’ space related activities (like watching an eclipse), but interest narrows dramatically as the conversation shifts to traveling to distant locations (like Mars).

- There are 3 groups as it relates to interest in NASA and space exploration; highly interested (10-20%), not interested at all (around 30%), and a large group of people interested to varying degrees (50-60%).

- Americans have made their priorities for NASA very clear : climate monitoring, asteroid defense, and scientific research.

- Questions surrounding NASA’s budget seem to largely conform to the interest groups, with a significant group being susceptible to framing and persuasion.

- Younger Americans are slightly more inclined to agree NASA’s budget is too low, and are more likely to be interested in space tourism and traveling off planet.

- There remains a pervasive gender gap throughout the survey questions that mandates more study and analysis.

- Democrats are more likely to support NASA’s work on climate monitoring, scientific research, and the search for life on other planets.

- The public expresses mixed feelings on whether the US is a leader in space, with most agreeing that it is to some degree, but the data is unclear on how many believe the US to be the sole leader in space.

- The public seems conflicted on the role of crewed missions in space exploration, with the ‘interest’ groups again making their differences apparent.

This is the American public as it relates to space policy heading into the 2020 election. Generally favorable views of NASA, but most American’s aren’t intensely invested, and please don’t ask them about the budget. Priorities tend to be Earth-centric, but there is support for crewed missions in some corners.

Differences exist along generational, gender, and partisan lines, some of which are predictable, others of which require more analysis to fully understand. Further analysis will not only explore these differences, but also include analysis of racial, educational, and geographical data to identify the dynamics at play there as well.

The relatively broad unity and positivity that Americans share regarding NASA and space exploration is not set in stone. There have been few upheavals in American life much like the tumult faced so far in 2020, and there are numerous forces at play that could upend this rough national consensus on NASA and space exploration.